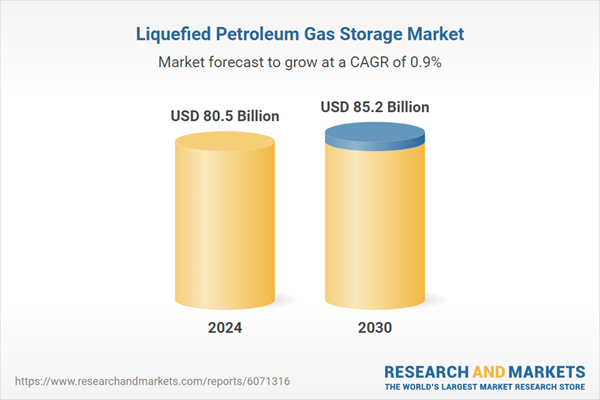

The global market for Liquefied Petroleum Gas Storage was estimated at US$80.5 Billion in 2024 and is projected to reach US$85.2 Billion by 2030, growing at a CAGR of 0.9% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Liquefied Petroleum Gas Storage market.

Segments: Storage Type (Pressurized tanks, Refrigerated tanks)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

The analysts continuously track trade developments worldwide, drawing insights from leading global economists and over 200 industry and policy institutions, including think tanks, trade organizations, and national economic advisory bodies. This intelligence is integrated into forecasting models to provide timely, data-driven analysis of emerging risks and opportunities.

Global Liquefied Petroleum Gas Storage Market - Key Trends & Drivers Summarized

Why Is Liquefied Petroleum Gas (LPG) Storage Becoming a Critical Component of Energy Infrastructure?

The storage of liquefied petroleum gas (LPG) has become an integral aspect of global energy infrastructure, driven by the increasing reliance on LPG as a cleaner alternative to conventional fossil fuels. LPG, a mixture of propane and butane, is widely used for residential heating, cooking, industrial applications, and automotive fuel. As demand for LPG continues to rise across emerging and developed economies, the need for efficient storage solutions has intensified. Traditional storage solutions, such as pressurized tanks and underground caverns, are being optimized with advanced materials and safety mechanisms to accommodate the growing volume of LPG consumption. Additionally, the expansion of international LPG trade has further necessitated large-scale storage facilities at seaports, refineries, and distribution hubs. The increasing shift towards decentralized energy systems, where LPG serves as a reliable off-grid fuel source, has also contributed to the rising importance of storage infrastructure. Moreover, the volatility in global energy markets, coupled with geopolitical uncertainties, has reinforced the need for strategic LPG reserves to ensure energy security. With advancements in cryogenic and pressure-resistant storage technologies, the industry is witnessing significant innovations that enhance storage efficiency, minimize losses, and ensure environmental safety.What Are the Leading Technologies Driving LPG Storage Advancements?

The development of cutting-edge storage technologies has played a crucial role in improving the efficiency, safety, and sustainability of LPG storage facilities. One of the most significant advancements is the adoption of double-walled and vacuum-insulated storage tanks, which minimize temperature fluctuations and prevent LPG losses due to evaporation. Additionally, underground storage solutions, such as salt caverns and depleted gas fields, have gained traction due to their ability to store large quantities of LPG with enhanced safety and cost-effectiveness. The use of high-strength composite materials in above-ground storage tanks has further improved durability while reducing maintenance requirements. Another key innovation is the implementation of smart monitoring systems that leverage the Internet of Things (IoT) and real-time data analytics to track LPG levels, detect leaks, and optimize inventory management. Automated pressure regulation systems have also enhanced the stability of LPG storage, preventing sudden fluctuations that could lead to hazardous situations. Furthermore, advancements in liquefaction and regasification processes have enabled the seamless integration of LPG storage with global supply chains, facilitating efficient distribution to end-users. With increasing environmental concerns, companies are investing in carbon capture technologies and sustainable storage practices to reduce emissions associated with LPG storage and handling.How Are Market Dynamics Shaping the LPG Storage Industry?

The demand for LPG storage solutions is heavily influenced by market dynamics such as supply chain disruptions, shifting energy policies, and fluctuating crude oil prices. As global LPG production increases, driven by higher extraction rates from natural gas processing and oil refining, storage capacity expansion has become a priority for energy providers. The growth of the petrochemical sector, where LPG serves as a key feedstock for manufacturing plastics and chemicals, has further contributed to the rising need for robust storage infrastructure. Additionally, government initiatives promoting clean energy adoption have led to an increase in LPG consumption, particularly in developing regions where access to traditional energy sources remains limited. In contrast, price volatility in the oil and gas industry has prompted companies to invest in strategic storage reserves to manage supply-demand imbalances effectively. The rise of floating storage units, particularly in coastal regions and areas prone to extreme weather conditions, has also emerged as a cost-effective solution for temporary LPG storage during transit. Meanwhile, stricter safety regulations and environmental standards have prompted investments in state-of-the-art storage facilities equipped with advanced leak detection and fire suppression systems. Furthermore, the increasing popularity of LPG as an alternative fuel in the automotive and maritime sectors has reinforced the need for efficient storage solutions that support refueling infrastructure.What Are the Key Growth Drivers Accelerating the LPG Storage Market?

The growth in the liquefied petroleum gas storage market is driven by several factors, including rising LPG consumption, technological advancements, and increasing investments in energy security. One of the primary drivers is the expanding use of LPG as a clean cooking fuel, particularly in Asia, Africa, and Latin America, where governments are implementing subsidy programs to promote its adoption. The industrial sector`s growing reliance on LPG for heating, manufacturing, and power generation has further boosted demand for large-scale storage facilities. Additionally, the global shift towards sustainable energy solutions has led to increased LPG adoption as a transitional fuel, particularly in regions phasing out coal and diesel-based energy sources. The expansion of LPG export-import networks, driven by the surge in production from shale gas and natural gas liquids (NGLs), has necessitated the construction of strategically located storage terminals. The integration of digital technologies, such as blockchain-enabled tracking systems and AI-driven predictive analytics, has also enhanced supply chain efficiency, reducing storage costs and minimizing losses. Another key factor contributing to market growth is the increasing adoption of LPG as a marine and transportation fuel, supported by regulatory initiatives aimed at reducing carbon emissions. Furthermore, the rising investments in modular and scalable LPG storage solutions have facilitated market expansion in remote and underserved regions. With continuous advancements in material science, automation, and safety standards, the LPG storage market is poised for sustained growth, playing a vital role in the global energy transition.Report Scope

The report analyzes the Liquefied Petroleum Gas Storage market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.Segments: Storage Type (Pressurized tanks, Refrigerated tanks)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pressurized tanks segment, which is expected to reach US$56.4 Billion by 2030 with a CAGR of a 0.7%. The Refrigerated tanks segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $21.9 Billion in 2024, and China, forecasted to grow at an impressive 1.9% CAGR to reach $15.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Liquefied Petroleum Gas Storage Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Liquefied Petroleum Gas Storage Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Liquefied Petroleum Gas Storage Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abu Dhabi National Oil Company (ADNOC), AmeriGas Partners, L.P., Bharat Petroleum Corporation Limited (BPCL), BP PLC, Chart Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 36 Featured):

- Abu Dhabi National Oil Company (ADNOC)

- AmeriGas Partners, L.P.

- Bharat Petroleum Corporation Limited (BPCL)

- BP PLC

- Chart Industries, Inc.

- China Gas Holdings Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- ConocoPhillips

- Energy Transfer LP

- Exxon Mobil Corporation

- Ferrellgas Partners, L.P.

- Gazprom PJSC

- Indian Oil Corporation Ltd.

- Linde plc

- Petredec

- QatarEnergy

- Royal Dutch Shell plc

- Royal Vopak

- Saudi Aramco

- Suburban Propane Partners, L.P.

Tariff Impact Analysis: Key Insights for 2025

Global tariff negotiations across 180+ countries are reshaping supply chains, costs, and competitiveness. This report reflects the latest developments as of April 2025 and incorporates forward-looking insights into the market outlook.The analysts continuously track trade developments worldwide, drawing insights from leading global economists and over 200 industry and policy institutions, including think tanks, trade organizations, and national economic advisory bodies. This intelligence is integrated into forecasting models to provide timely, data-driven analysis of emerging risks and opportunities.

What’s Included in This Edition:

- Tariff-adjusted market forecasts by region and segment

- Analysis of cost and supply chain implications by sourcing and trade exposure

- Strategic insights into geographic shifts

Buyers receive a free July 2025 update with:

- Finalized tariff impacts and new trade agreement effects

- Updated projections reflecting global sourcing and cost shifts

- Expanded country-specific coverage across the industry

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abu Dhabi National Oil Company (ADNOC)

- AmeriGas Partners, L.P.

- Bharat Petroleum Corporation Limited (BPCL)

- BP PLC

- Chart Industries, Inc.

- China Gas Holdings Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- ConocoPhillips

- Energy Transfer LP

- Exxon Mobil Corporation

- Ferrellgas Partners, L.P.

- Gazprom PJSC

- Indian Oil Corporation Ltd.

- Linde plc

- Petredec

- QatarEnergy

- Royal Dutch Shell plc

- Royal Vopak

- Saudi Aramco

- Suburban Propane Partners, L.P.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 80.5 Billion |

| Forecasted Market Value ( USD | $ 85.2 Billion |

| Compound Annual Growth Rate | 0.9% |

| Regions Covered | Global |